General information

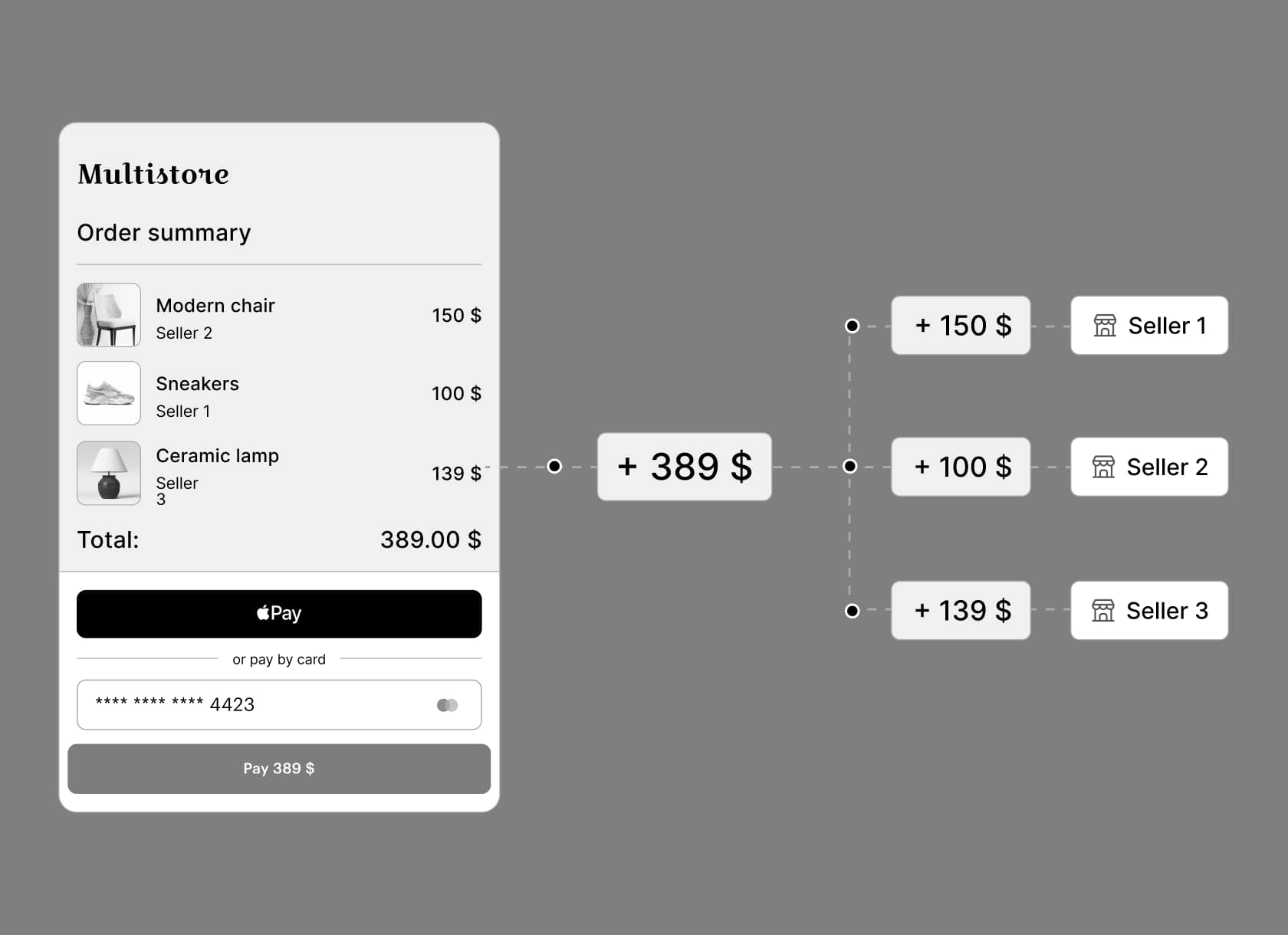

Split payment is a type of payment where the total amount is automatically distributed among multiple recipients (sub-merchants).

How it works:

- The payer adds items from different sellers to the cart and pays with a single transaction.

- Based on the information received in the request — sub-merchant identifiers and amounts — we distribute the funds among the sub-merchants, according to the configured commission settings.

Features:

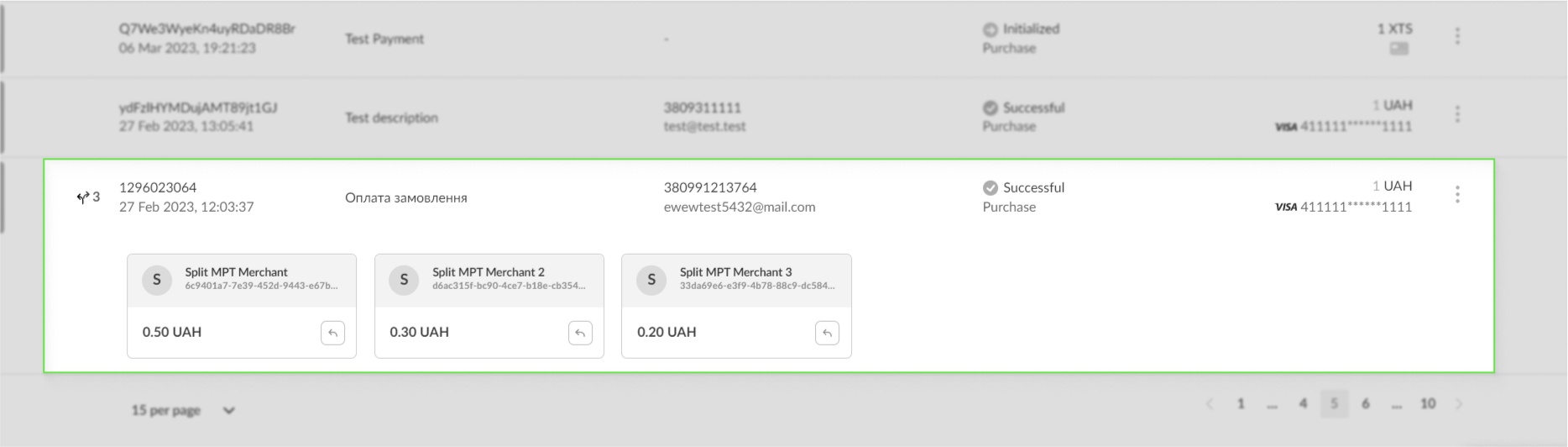

- One-step split payments have the purchase transaction type and are displayed as such in the merchant portal.

- The merchant portal contains information both about the entire split payment and the individual sub-payments it includes.

- Financial Line supports both one-step and two-step split payments.

caution

Note: primary payments (purchase, auth, credit, lookup, P2P) must have a unique order ID. In case the selected order ID is already set for another transaction, an error will be received when creating the order.